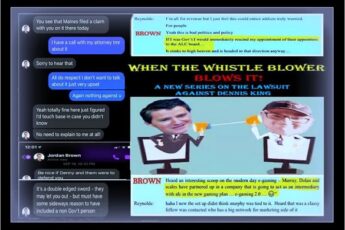

A CONSPIRACY TO COMMIT FRAUD: “PREAMBLE” TO PART 2 (Complaint to the PEI Law Society Against Billy Dow)

A Four-Part Series Exposing E-Gaming As An Elaborate Conspiracy To Commit Fraud

Preamble to Part Two: The E-Gaming Loan

PEI Law Society Complaint against Billy Dow

This article is a supporting document (Appendix “A”) in a formal complaint I’m filing with the PEI Law Society against lawyer William F. Dow (“Billy Dow”). I’m convinced that the documentary evidence supports my belief that e-gaming involved an elaborate conspiracy to commit fraud. This article deals with Billy Dow’s role in that conspiracy, especially pertaining to the e-gaming loan.

To prove a conspiracy to commit fraud, it is necessary to first map out chronologically how a plan came together to access provincial government funds for the e-gaming project, and how that plan was then executed over approximately a 2 1/2 year period of time. That involves a careful overview of the decisions and actions that were taken by key players within government to acquire and transfer $1,120,000 to McInnes Cooper law firm, funnelling it through the Mi’Kmaq Confederacy to create the impression that government’s e-gaming initiative was a legitimate third-party project independent from government. It wasn’t. As Robin Dolittle noted in her 2015 Globe and Mail investigative report on e-gaming: “The fact that the [e-gaming] plan was illegal – and had elsewhere been used by the Mafia – is one of this story’s more mundane details.”

McInnes Cooper lawyers told the Auditor General (Jane MacAdam) – in the course of her investigation into e-gaming – that the Minister of Finance at the time, Wes Sheridan, had made an initial commitment of $1,210,000 to the Mi’Kmaq Confederacy of PEI (MCPEI) which was, in turn, to be paid to McInnes Cooper to manage the project.

Although McInnes Cooper consistently claimed that the law firm only represented MCPEI, insisting they only did work on the e-gaming project for the MCPEI under the auspices of a “solicitor-client relationship,” Minister Sheridan told the Auditor General (AG) that McInnes Cooper acted as the project manager for e-gaming, and that was the conclusion the AG also reached, based on documentary evidence. MacAdam viewed the reason provided by the law firm for refusing to provide her with e-gaming documentation – solicitor/client privilege – as completely groundless:

“As well, during our work we obtained documentary evidence, where the local law firm [McInnes Cooper] requested payment on final invoices and stated they were assisting both government and MCPEI by acting as project manager on the file.” [AG E-gaming Report, section 3.16, p. 15].

“The local law firm [McInnes Cooper] would not discuss this file with our office, citing solicitor/client privilege, with their client MCPEI. However, project management services are not protected by solicitor/client privilege.” [AG E-gaming Report, section 3.17, p. 15].

Acquiring the total amount of $1,210,000 Wes Sheridan promised to the MCPEI involved a dedicated and calculated strategy to (a) approve the e-gaming loan in contravention of the Financial Administration Act; (b) arbitrarily change budgets to present the work in such a way as to hide the actual costs, even when the scope of the project wasn’t altered; (c) ignore financial monitoring and reporting requirements; (d) disburse funds to McInnes Cooper without the required invoices and claims, in contravention of financial management protocols and procedures; and (e) ignore and fail to act on specific provisions of the e-gaming loan agreement that would have protected government’s interests. The source documents and details concerning these matters will be provided in a subsequent article, which will also be submitted with my complaint (Appendix “B”).

All of this was done with the single-minded goal of accessing the full amount of $1,210,000 initially agreed upon, and apparently promised by Wes Sheridan. This happened despite the fact that most of the work specified as “deliverables” in the e-gaming loan budget were not completed, and in most instances, not even begun. Rather than acting in compliance with the PEI Law Society’s strict Code of Conduct, Billy Dow failed to protect his client’s interest, most likely because he had a personal and financial stake in the e-gaming – and subsequently, “Financial Transaction Platform” – initiatives.

Billy Dow’s “Conflict of Interest” in E-gaming

Lawyer Billy Dow’s key contribution to – and participation in – fraudulent activity primarily involved his handling of the e-gaming loan of $950,000, although that was by no means his only involvement in the e-gaming project.

On March 2, 2017, former Leader of the PEI NDP Party (Michael Redmond) filed a complaint with the PEI Law Society against Billy Dow alleging a “conflict of interest” as a result of Dow’s involvement with the signing of a Memorandum of Understanding (MOU) between the PEI government and Trinity Bay Technologies Inc., a wholly-owned subsidiary of CMT. Dow had purchased shares in CMT in July, 2011, and was involved in the MOU that was signed more than a year later – something the Auditor General called a “perceived conflict of interest.”

In his Written Response to Redmond’s complaint, Dow argued – as he had had previously stated in a 2015 Letter he sent (via email) to Globe and Mail reporter Robyn Doolittle – that he was totally unaware that TBT was a wholly-owned subsidiary of CMT, and when he became aware, he took immediate steps to remove himself from the file:

Redmond initially filed a complaint with the Secretary-Treasurer of the PEI Law Society, who ruled that there was no conflict of interest. He subsequently appealed that decision to the PEI Law Society’s Disciplinary Committee. In its Decision, the Committee also concluded that there was no conflict of interest, and that no disciplinary action against Dow needed to be taken, stating in its report:

Redmond’s allegation that Billy Dow had a conflict of interest was limited to Dow”s involvement in the Memorandum of Understanding (MOU) between Trinity Bay Technologies/Simplex and the PEI government. Although Dow claimed that he didn’t know Trinity Bay Technologies was a 100%-owned subsidiary of CMT, it’s hard to accept that as being true, given the fact that Dow failed to disclose the full extent of his prior involvement in spearheading the MOU, although no hard documentary evidence or first-hand testimony has yet surfaced proving Dow knew he was in a conflict of interest involving himself with the MOU. One can only speculate as to why Dow misled Ms. Doolittle concerning the full extent of his involvement with the MOU when he stated:

“In in the summer of 2012 I was asked by Innovation PEI to review an MOU that had been prepared by a company known as 7645686 Canada Inc, dba Trinity Bay Technologies. I did not prepare or negotiate the MOU. I reviewed the MOU and advised Innovation on what the document meant.”

What Dow failed to disclose is that the MOU – and the business arrangement with TBT that the MOU initiated – was Dow’s idea!

After learning from a fellow CMT Investor that PEI was on the cusp of possibly losing out on the development of the Financial Transaction Platform to Nova Scotia, Dow began communications with CMT’s lawyer (Gary Jessop) to draft the MOU and send it to him. Court documents confirm that Dow sent it to Cheryl Paynter and Melissa MacEachern with Innovation PEI for signature. It’s important to note that no changes were made to the MOU by Dow or Innovation PEI. The Auditor General was aware of this fact and reported it as “unusual” activity for external legal counsel (Dow):

To be clear, “Innovation PEI’s external legal counsel” at the time was Billy Dow.

The Auditor General went on to point out precisely why the MOU was unusual:

Ponder this revelation for a moment: “…the request for the business arrangement” came from Bily Dow, the external legal counsel retained for the e-gaming project, who was at the time an investor in CMT. Yet, Dow’s version of events submitted to both the Globe and Mail and the PEI Law Society was that his involvement in the MOU was limited to only a “request to review.”

Despite acting as legal counsel for the government, being an investor in CMT, Dow would obviously want to see the project succeed, and when it looked like CMT (with it’s TBT subsidiary) was going to take its business to Nova Scotia, Dow took it upon himself to initiate a new business agreement. And it wasn’t just any business agreement, but one that contained exclusivity clauses that would prevent CMT/TBT from discussing its business proposals for a financial transaction platform with any other party, including the Nova Scotia government. And of course the PEI government made the same legal agreement with CMT/TBT promising an exclusive relationship during the time the MOU was in effect. The alleged breach of those exclusivity clauses by the PEI government is what resulted in the CMT lawsuit.

It was Dow’s connection with a Capital Markets Technologies (CMT’s) investor which put CMT at the very centre of the e-gaming initiative in the summer of 2011. Given that inside and intimate knowledge, it is simply not reasonable to believe that Dow would not have known that the company (Trinity Bay Technologies) wasn’t registered by the local e-gaming company for the purpose of setting up Simplex’s Financial Transaction platform for e-gaming.

Whether Dow knew or didn’t know TBT was essentially the same corporate entity as CMT is of little consequence; the basis for my allegation that Dow had a conflict of interest stems from the fact that he was retained by the PEI government long before any discussions about a MOU took place – months before he purchased shares in CMT – and that he was at that time aware that CMT was the principal company involved in the entire e-gaming project.

Part I of my Two-fold Complaint Against Billy Dow

The first part of my two-fold complaint against Billy Dow is that he was indeed in a conflict of interest with the e-gaming file, but not simply because of his later involvement with the MOU involving TBT, but because of his involvement in handling the e-gaming loan with the Mi’Kmaq Confederacy.

Dow’s primary conflict of interest resulted from his investment in an e-gaming company (CMT) that would only become profitable for its shareholders if the e-gaming/financial transaction platform project got off the ground and was successful. That platform could be used for many things, e-gaming being one of them, so even if e-gaming failed to launch, there was potential for financial rewards for Dow as long as CMT could successfully negotiate a deal with the provincial government to establish the financial transaction platform.

The e-gaming loan for $950,000 that Dow handled for Innovation PEI and the PEI government was at the very heart of the e-gaming working group’s strategy for success with both “e-gaming” and the establishment of a financial transaction platform, and at all times, CMT was the principal company involved with that strategy.

Without getting into too much detail, CMT had exclusive North American rights to technologies and services owned by Simplex, a company in the U.K., and the plan was to set up the financial transaction platform and processing infrastructure needed to make e-gaming a reality in PEI. Billy Dow attended e-gaming working group meetings and, as an investor in CMT, was clearly aware of how CMT factored into the overall e-gaming/financial transactions platform strategy.

In early summer of 2011, the drive to establish an e-gaming financial transaction platform was the principal focus of attention with the e-gaming working group. Although Dow told Robyn Doolittle in a letter that he “…was told that the Company [CMT] was involved in technology related to the banking industry,” he knew full-well when he invested in the company that CMT was being considered by the PEI government to establish a financial transaction hub in PEI and, in addition, to bring gaming companies to the Island, such as the one CMT did manage to attract to PEI around that time, Virgin Gaming.

Dow’s knowledge of CMT and how CMT was involved with the e-gaming/financial transaction platform project was both intimate and extensive. According to Kevin Kiley, as relayed to staff at the Auditor General’s office in the course of an interview held May 18, 2017, Billy Dow was retained and was acting for the government on the e-gaming file from the very first meeting establishing McInnes Cooper as the e-gaming project manager back in February, 2010 (See, paragraph #2) as is clearly indicated in paragraph 5 in the interview transcript:

“Mr. Kiley indicated that he was advised government lawyer was Bill Dow as well as Barb Stevenson until about Fall of 2010. They met with the working group from time to time.”

And Kiley later confirmed (in Paragraph 2 of the “final comments” section) that Dow had been specifically enlisted by the province to provide the PEI government with legal counsel on the e-gaming project:

“Government subsequently confirmed with us, on or about March 10, 2010, that they had retained the law firm of Carr, Stevenson and MacKay to represent it in the [e-gaming] initiative.”

This fact was further confirmed in Gary Scale’s Statement of Defence filed with the PEI Supreme Court where it states:

“Scales was advised by PEI on or about March 2010 that PEI had retained its own external counsel, Carr, Stevenson & McKay (“CSM”), to represent PEI in dealings with respect to the e-gaming initiative. CSM attended and prepared legal documents for PEI.” (p.1)

When Dow was challenged by the Globe & Mail, Opposition Members, and Michael Redmond’s complaint to the law society he failed to disclose the fact that he had been retained as external legal counsel for the government on the e-gaming initiative in February, 2010, but spoke only of his much later involvement in the 2012 MOU, which he clearly minimized to an extent that can only be construed as intended to mislead.

As McInnes Cooper lawyer Kevin Kiley noted in the above-noted transcript of his interview with staff from the Auditor General’s office, “Simplex was identified as being able to give them the processing capability they needed,” for e-gaming, and more specifically, “processing capability” meant the financial transaction platform. Again, Billy Dow was invested in CMT, the North American exclusive agent for Simplex, so the only way for Dow to profit from the e-gaming/financial transaction platform owned by Simplex was through CMT.

Dow was therefore clearly in a conflict of interest when he represented the government’s interest with his handling of the e-gaming $950,000 loan, given his personal financial interest in seeing the e-gaming/financial transaction project go forward and be successful.

It is impossible to determine the extent to which this personal interest clouded his ethical and professional judgment; however, given the extent to which he failed to act to protect government’s (and taxpayer’s) interest with his handling of the e-gaming loan – which will be outlined in detail in my next article “The e-gaming Loan” – the facts suggest it was significant.

So, the first part of my two-fold complaint to the PEI Law Society is my allegation that Dow’s conflict of interest began when he purchased shares in CMT on July 28, 2011 [See List of Securities (p.9), tabled in the PEI Legislative Assembly, May 13, 2016], well over a year after Billy Dow and his law firm were retained by the PEI government on the e-gaming file, and months before he represented the government [Innovation PEI] with his involvement with the e-gaming loan.

The second part of my two-fold complaint involves numerous unethical and illegal decisions and actions undertaken by Dow, which amounted to a failure to protect the government’s interests re: the e-gaming loan which Premier MacLauchlan was forced to write-off as a complete loss shortly after becoming premier in 2015.

Those actions will be presented in detail and explained in “Part 2” of this 4-part series – which I hope to have completed and posted in another few days.