Episode #8: The Securities Investigation against Maines & CMT – Part I

![]()

Preamble

It’s not possible to understand Judge Campbell’s ruling, or the ongoing cover-up of this multi-pronged and continuing scandal, without knowing why Steven Dowling’s six-year old affidavit features so prominently in the Motion to Dismiss ruling by Judge Campbell. The answer lies in what happened with the Securities Investigation and Scheduled Hearing against Paul Maines and CMT that Dowling initiated and commandeered.

That story can’t be told in a few paragraphs. I’m therefore breaking the information up into three separate “parts” and episodes as follows:

- Part 1: The announcement of a Securities Hearing against Maines & CMT

- Part 2: Preparations by CMT for the Securities Hearing

- Part 3: The Settlement Agreement

++++++++++++++++++++++++++++++

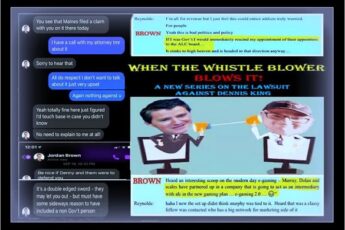

Episode #8 (Part 1): Announcing a Securities Hearing against Maines & CMT

When Steven Dowling initiated the Securities Investigation against Paul Maines and CMT on September 18, 2012, Gary Jessop – CMT’s lawyer – happened to be in PEI, as was stated in Jessop’s sworn Affidavit:

“Philip Walsh and I were in Charlottetown for the purpose of negotiating the agreement between 7645686 and Innovation PEI contemplated by the MOU…”

You would expect that Dowling would be anxious to talk to Jessop. He wasn’t.

Despite numerous attempts by Jessop to meet or talk with Dowling to learn what basis there was for the allegations which had frozen the company’s activity, and why an investigation had been commenced, Dowling would not communicate with him. That refusal to communicate goes to CMT’s claim of malfeasance.

Campbell recognizes that one of the claims for malfeasance by CMT/764 was, as he puts it in paragraph 4, ” initiating a securities investigation against the plaintiffs for ulterior motives,” then further notes in paragraph 61 of his ruling that “He [Jessop] made various efforts to contact Dowling during the course of the securities investigation,” and then elsewhere states in paragraph 479:

Para 479: According to Jessop’s affidavit, on September 20, 2012, Jessop emailed Dowling stating he was counsel for “Capital Markets/Trinity Bay” and that he would like to meet with Dowling to get further information on what he understands might be a complaint against Trinity Bay. Dowling responded on September 21, 2012 indicating he was not aware of a complaint referencing Trinity Bay. Jessop then suggested the claim might reference FMT and asked Dowling to let him know if he would like to meet Jessop to discuss it. Dowling thanked him for his email and advised he would let him know. Jessop made other efforts to arrange a meeting with Dowling, but Dowling did not accept the invitations to meet until later in the process.

The Truth?

Dowling didn’t respond to Jessop on September 21, 2012 as Campbell states in para. 479; but his Administrative Assistant left a voicemail message, which Campbell would know from Jessop’s affidavit, In paragraph 30 Jessop says:

Dowling’s refusal to provide any information to Jessop or Maines over a four-month period (September 18 – January 18) finally prompted Jessop to go over Dowling’s head and write to the Department of Justice seeking information about the investigation. As Jessop states:

Ms. Curley responded eight days later on January 29 to inform Jessop that she had forwarded his letter to – of all people – Mr. Dowling.

Gary Jessop and Paul Maines were then kept completely in the dark for the next two weeks. On February 13, 2013, at roughly 4pm, Dowling’s Affidavit and Hearing notice were served on Paul Maines and CMT.

The very next morning, the senior communications officer with the Department of Justice issued the following Press Release to every news outlet in Atlantic Canada (Note: I highlighted the words and phrases I think we all would like to see associated with our name in a government press release):

After desperately trying to find out “who” was making “what” complaint about “what” issue – and being told absolute nothing – Maines and CMT were blind-sided with roughly ten working days to file a defense, with no information to go on other than what was in Dowling’s Affidavit.

The alternative was to accept whatever ruling the Securities Commission deemed proper, a point that was “double-emphasized” in the Hearing Notice:

With so little time and information to mount a proper defence against the allegations in his Affidavit, Dowling probably assumed that Maines and CMT would be forced to accept whatever decision the Commission ended-up making and just go away. I suspect he never imagined what was coming next – (the next episode) – but here’s a ‘spoiler alert’ – CMT and Paul Maines did not go away.

CMT’s lawyer noted in a subsequent court filing, that the preparation for that Securities Hearing cost was in excess of $150,000. A Bay Street law firm specializing in securities law was immediately retained, and the lawyer taking the case – Mary Biggar – filed a Response Motion on March 1, 2013.

Biggar also began reaching out for documents and information from a number of key players. including the entire membership of the notoriously “secret” “gaming committee” (Wes Sheridan; Gary Scales; Kevin Kiley; Don MacKenzie; and Mike O’Brien). Biggar was also seeking to “cross examine” Steven Dowling regarding the allegations in his Affidavit…..but now I’m getting ahead of myself. Stay tuned.

The Consequences?

None.

Article Comments

Barb MacFarlane

November 3, 2019 12:08 amThe next episode should be very interesting.

Anonymous

November 3, 2019 8:08 amYour summing things up very nicely Kevin. I’ve been reading my way through Judge Campbell’s decision trying to follow his reasoning and logic, with the facts that I know. Just glad this is under appeal because I think we all need to know what is really right here, Maine ,Campbell, you, or whoever else has an opinion on this tangled web. Maybe it will answer the question: does corruption and entitlement, cover ups and collusion exists at the very highest level on PEI?