Episode #9: The Securities Investigation Against Maines & CMT – Part II

![]()

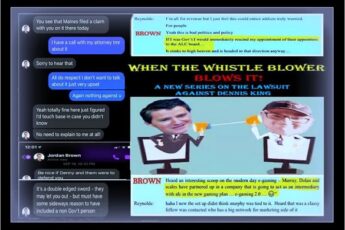

Episode #9: The Securities Investigation Hearing that Never Happened!

Episode #8 set the stage for the Securities Investigation Hearing scheduled to take place against Paul Maines and CMT on March 7, 2013. This episode deals with the period of time from when the Hearing Notice was served (February 14th) to just after the scheduled Hearing on March 7, 2013.

This episode relies heavily on screen captures from documents or quotations because it is of such central importance in this entire story: it is long and not something you can skim through on a commercial break – so be forewarned.

A Brief Recap Leading up to Hearing Preparations by Maines & CMT

The last episode left off with CMT’s corporate lawyer, Gary Jessop, desperately trying to get information from Steven Dowling – the Department of Justice lawyer working for the PEI Securities Commission – after hearing rumours that Dowling had apparently launched an investigation against Maines and CMT.

Jessop was in Charlottetown at the time concluding negotiations with Innovation PEI on a Financial Transactions Platform “hub” initiative they’d been working on with the province for nearly two years. He tried a number of times to meet or speak with Dowling with no success.

As the days passed, although Dowling wouldn’t talk with either Jessop or Maines, it seemed he was talking to other people, and the word on the street was that Maines and CMT were the “target” of Dowling’s Securities Investigation because Maines had bilked some elderly woman with cancer out of her life savings – a claim that was later thoroughly confirmed to be fictitious by an ex-RCMP officer hired by CMT to investigate the claim. That such a thing never happened was also reported by Robin Doolittle in her 2015 Globe and Mail article on e-gaming.

As Jessop noted in an email letter to Billy Dow dated October 8th, although Dowling never communicated with him directly, he did receive one communication which put his mind at ease that Maines and CMT/FMT were not the targets, and it was all apparently just rumours run wild:

“I did receive a call from Dowling’s office {not Dowling) on Thursday October 18, 2012 and was told that he is aware that we are available to talk and that he had no need to talk with us and if there becomes a need to contact us he will. The only conclusion that I can glean from this is that Trinity Bay and Capital Markets are not the targets of the investigation.”

What Securities Investigator would initiate an investigation against an international company doing business with the PEI government and have “no need” to speak with the person(s)/companies being investigated, especially knowing the potential harm and financial losses the investigation would cause….especially when the person/company under investigation are both forthcoming and anxious to address any and all concerns to remedy the situation? No one. Ever. That is, before the inaugural PEI investigation launched by Dowling – still the only one listed on the PEI Securities Commission Website.

Although Jessop’s conclusion that Maines and CMT were not targets was completely reasonable, it was unfortunately also dead wrong. Maines continued to hear from others – including people Dowling had interviewed – that the investigation was indeed targeting him and CMT.

After nearly five months without getting any response from Dowling, Jessop finally wrote to the Deputy Minister of Justice at the time, Shauna Sullivan-Curley on January 21, 2013. The urgency of the situation coupled with the ongoing harm being caused to CMT and Maines is palpable throughout Jessop’s letter to the Deputy Minister. He was seeking urgent intervention because, as he put it, his clients “…have done nothing wrong”:

Sullivan-Curly informed Jessop 8 days later that she had forwarded his letter to Dowling!

Of course Jessop’s promise that his clients will defend themselves “against any claims made against them” was founded on the presumption that his clients wouldn’t be denied their constitutional rights to a fair hearing in accordance with the principles of natural justice. Again, a perfectly reasonable assumption, but unfortunately, Jessop was dead wrong about that as well.

Preparations for the Hearing

After receiving the Notice about a Securities Hearing to be held on March 7 – with all responding materials having to be filed by March 2 – Maines immediately drove to Toronto to work with Mary L. Biggar, a Securities Lawyer with a Baystreet firm retained by CMT – to put together a defence.

The best way to explain what happened during the short time since Biggar was hired to the Hearing date is to break things up chronologically and let the documents speak for themselves.

February 14, 2013

Paul Maines and CMT are served a “Notice of Preliminary Motion” by the PEI Securities Commission with a scheduled Hearing date of March 7, 2013. The Notice indicates that the Commission will be seeking a “Cease-Trade Order” against Paul Maines and CMT on grounds that it is in the “public interest.” The Notice states that the evidence relied upon will be as follows:

If they planned to attend, Maines and CMT were required to file all “responding materials” not later than 5 days before the date of the Hearing (March 2, 2013).

February 15, 2013

The PEI Department of Justice issues a Press Release to every news outlet in Atlantic Canada announcing the Hearing on March 7th, asking Islanders to essentially be on the look out for fraudulent activity by Paul Maines and to report anything they deem to be suspicious if such contact occurs to the PEI Securities Commission. Ouch!

February 25, 2013

Biggar sends emails to the Superintendent announcing that in addition to a number of sworn affidavits, Maines and CMT will be calling witnesses. A request to schedule a cross-examination of Dowling’s Affidavit was also submitted.

February 26, 2013

Maines and CMT received a “Procedural Direction” from the PEI Securities Commission on February 26 informing them that the recently announced “Public” hearing Notice announced throughout Atlantic Canada just days earlier, was now to be rendered “secret,” and all documents were to be “sealed” and completely kept from any public scrutiny:

No explanation was provided as to why something so widely announced as a public hearing suddenly became “prejudicial to the public interest” and totally secretive.

February 26, 2013

Biggar receives an email from the Superintendent’s Office with the following information:

Ms. Biggar:

This is in response to your emails dated February 25, 2013 requesting cross-examination and witness evidence in this matter. We have noted the position of staff in accordance with the email of Mr. Vanderlaan of today’s date. Your request for cross examination and witness evidence is denied.”

February 27, 2013

Not willing to accept that decision, Biggar pursued the matter on grounds that it was a violation of natural justice to deny the opportunity to address the issues that had precipitated the investigation – her clients had a right to defend themselves. She was subsequently informed on February 27 that she would have to make a Motion to allow cross-examination and witnesses:

February 28, 2013

Biggar also sent individual letters dated February 28 to each member of the secret “gaming committee” (Gary Scales; Wes Sheridan; Chris LeClair; Kevin Kiley; Don MacKenzie) requesting records materially relevant to the Hearing:

February 28, 2013

Biggar also wrote to Cheryl Paynter on February 28 concerning information that Maines and CMT were alleging about how Chris LeClair and Wes Sheridan were advancing a different proposal from different companies in violation of the MOU:

Biggar never received any reply from any member of the gaming committee, nor did she receive a reply from Cheryl Paynter. Knowing that she did not have the power to “compel” responses, documents or attendance of witnesses, Biggar was left to rely on the decision of the Superintendent.

A key part of the “malfeasance” claim against a number of the dependents in the current CMT/764 lawsuit is that an attempt was underway in August/September 2012 to “undermine” the MOU in place for CMT/FMT complete negotiations toward an agreement with the PEI government to establish a “financial transaction hub” in PEI.

Maines alleges that the Securities Commission investigation suspending the almost-completed negotiations between CMT/FMT and the province, damaging CMT/FMT’s Global reputation and hurting business, was totally groundless (and it is the case that neither the name of the person “complaining” nor any document signifying a “complaint” has ever been produced).

Maines further contends that the investigation was deliberately orchestrated and launched to sabotage the deal that was about to be signed between the PEI government and CMT/FMT. The plan was to confirm through witness testimony and cross examination what Maines and CMT were certain had happened. That never happened with the Securities Commission. What Campbell had to say about those claims will be dealt with in a future episode. But it was a key issue during the Securities Investigation as you’ll see from the documentary evidence below.

March 4, 2019

As the Hearing date fast-approached, Biggar was still awaiting a response to her Motion to find out about cross-examination and witnesses. Three days before the Hearing date she received a “Submission Regarding Respondent’s Motion,” from the PEI Securities Commission saying they had concluded there was no need for Maines or CMT to cross-examine Dowling or call witnesses:

March 5, 2013

Chris LeClair – Robert Ghiz’s former Chief of Staff, whose records were all destroyed by Ghiz – had continued to work on the gaming file with McInnes Cooper – and is incidentally the chief “architect” behind the “Newco” company attempting to undermine the CMT/FMT/Simplex MOU agreement with the province [to be explained in a future episode].

Chris LeClair had also invested in the CMT/FMT initiative (while still Chief-of-Staff) and was a friend of Mark Rodd’s, and was on contract as a consultant with Rodd’s. LeClair sent the following email to Mark Rodd on March 5, 2013:

Why would LeClair refer to the “Maine’s affair” as a “shitstorm” that he expected would do enormous damage to him and his family?

I suspect that when LeClair learned that Maines and CMT had miraculously managed to mount a legitimate legal defence to the Motion Hearing, and had submitted sworn affidavits from a number of investors “correcting” false claims made in Steven Dowling’s Affidavit, and that they were pushing to be allowed to cross-examine Dowling and possibly call him as a witness, he must have realized that the sordid truth of what was really going on behind the scenes was about to be exposed. No doubt he would have been correct if the Hearing had proceeded as scheduled, but that wasn’t in the cards. The very same day – LeClair may not have sent that email if he had known – the Hearing was “Adjourned.”

March 5, 2013

After spending a gruelling two weeks preparing all the legal materials: a responding motion, a “factum”, preparing numerous sworn Affidavits, etc – Maines and his lawyer received a Notice on March 5 informing him the Hearing had been cancelled.

March 6, 2013

Not having heard from Paynter, Biggar sent another plea for cooperation:

She never got a response.

March 8, 2013

In something of a surprise twist to the story (to me at least) Maines was asked by the Securities Lawyer if he would provide a “voluntary statement” which he agreed to do on the day after the Hearing that never happened.

That 137-page transcript is a fascinating read. In particular, what Paul Maines explained about Tracey Cutcliffe – who used to work for Innovation PEI, but was contracted by CMT to work with government on CMT’s behalf. That’s all he had to go on at the time – what he was told by Ms. Cutcliffe – but what he said then can now be substantiated with new government documents (a future episode) so I want to draw your attention to what he told that Securities Lawyer from St. John (Jake Van Der Laan):

Maines was only going on what Cutcliffe had told him at the time, and had no documentary evidence to back up his claims. The “day it was expiring” refers to the MOU.

Not only was Maines happy to answer all the lawyer’s questions, Biggar and Maines (throughout the transcript) continually emphasized that they would provide Jessop (he was in Charlottetown at the time) or anyone else requested immediately to answer any and all questions as expeditiously as possible. They were clearly anxious to clear up the mess.

Maines and CMT were convinced the entire investigation and hearing was a ploy to derail CMT to make room for a new business venture with new people and new companies. They just didn’t have any real details or documents at the time to prove it, and were looking forward to getting to the bottom of things at the Hearing.

Van der Laan took Maines through the list of all 36 investors one-by-one. From the responses and discussions contained in the transcript in response to that line of questioning, it is clear that Maines did not “solicit” any investments. In fact, he only knew or ever met a handful of those 36 people, and that was for other reasons, including the business relationship with the province having nothing to do with soliciting investments (Paul Jenkins; Mark Rodd; and Chris LeClair for example).

No investor ever complained about their investment, nor did any of the investors claim that Maines “solicited” the investments they made. In addition, the false claims made by Dowling in his Affidavit that several investors had indicated to him that Maines solicited an investment from them were “corrected” by sworn Affidavits submitted by Biggar to the Securities Commission for the Hearing that never happened (Jeff Trainor Episode #4; Mark Rodd Episode #5; and Paul Jenkins Episode # 6.

April 9, 2013

The Securities Commission issued a Notice of Hearing to take place on April 22, 2013. Having been denied the right to call witnesses and cross-examine Dowling, Maines and CMT decided to go another route.

April 17, 2013

After the second hearing was scheduled, Maines and CMT launched a legal action challenging the Commission’s refusal to allow cross-examination and witnesses. That action would have “broke the seal” of secrecy and made all the documents public again. Perhaps not surprisingly, the Commission immediately wanted to “settle” the matter. On April 17, 2013 the Securities Commission issued a Notice that the Hearing scheduled for April 22 was adjourned to be “scheduled for a future date”. No new Hearing date was ever set.

Summary Observations

What Judge Campbell had to say about how Dowling conducted the Securities Investigation of Paul Maines and CMT will be dealt with in future episodes. However, you will get a general sense of what to expect on this matter from the following paragraph in his ruling:

Paragraph 483: I note that, even though Jessop was anxious to meet with Dowling as early as possible during the investigation, there was no obligation on Dowling to meet with Jessop, or Maines, or any other particular individual at any point in time. How he conducted his investigation was for him to decide, within the limits of the law.

How did this securities matter finally get resolved? That critically-important part of the story will be explained in the next episode.

Article Comments

Barb MacFarlane

November 9, 2019 12:09 pmA fascinating read, Kevin. Hope to read episode 10 later today.