Episode #21: Covering up the Breach of the MOU (Part III)

![]()

Episode #21: Covering up the Breach of the MOU (Part III)

++++++

PREAMBLE

The last two episodes have focussed on claims made by CMT that the PEI Government violated the legally-binding “exclusivity” clause within the Memorandum of Agreement (MOU).

Episode #19 provided background information on how the MOU came to be; what the four legally-binding provisions of the agreement entail; and how Wes Sheridan, Chris LeClair, and other members of the secret gaming committee breached the MOU in dealings with Keith Laslop, the CEO of another company, “Newco”.

On September 20, 2019, Jonathan Coady served two key documents dealing with Sheridan’s interactions with Laslop on CMT’s lawyer, John MacDonald. Coady did not provide those same documents to Judge Campbell. Five days later, Campbell issued his ruling without having considered those critically-important documents.

One of those documents proves that Wes Sheridan lied when he swore in cross-examination that he had no further contact with Laslop after a September 5 2012 email. The other document proved that Sheridan not only “solicited” a proposal from Keith Laslop, but choreographed when and how that proposal would arrive, in two ways: (1) Laslop was to wait until September 6, 2012, the date everyone thought the MOU with FMT was expiring, and (2) Laslop was instructed by LeClair, who Sheridan told to have Laslop direct the proposal to himself, and copy it to Cheryl Paynter and Allen Roach, so that way it would, as Sheridan put it, “…lead into a conversation” between the three of them.

Imagine a little domain about the size and shape of PEI wanting a train system. There is only room for one track and one train. For two years leading up to that fateful week in September 2012, the company that was to deliver that train track was FMT, and the train was the CMT/Simplex Global Transaction Platform.

Then, all of a sudden, and unbeknownst to Maines or CMT, Keith Laslop and his company “Newco” is back on the Island to implement a plan discussed with the secret gaming committee a year earlier, to set up a company to do transactions through the PEI Credit Union. In other words, Laslop was also proposing to deliver a “train,” only that train was Laslop’s payment processing company partnered with the PEI Credit Union able to process those financial payments.

Campbell says there was always only one train on the track during the MOU period, FMT, and argued in his ruling that the plaintiff failed to produce any evidence of another one (e.g., evidence of a breach of the MOU).

Notwithstanding Campbell’s opinion, given the “fresh evidence” obtained from FOIPs on this matter, documents withheld from the Court by Coady, I’m confident even Campbell would agree that to get to the truth of exactly what happened with Laslop and Newco, people need to be questioned at trial under oath.

My research revealed that there was a THIRD TRAIN in the “mix” at the time, and it was indeed Brad Mix who was pushing that option as the lead business recruiter for the province.

The evidence previously presented about Laslop strongly suggests a violation of the MOU. This episode explores another situation not dealt with in the lawsuit to date – but most definitely will be on a go-forward basis – which, I believe, also constitutes a breach of the MOU by the PEI Government. Nothing about this has ever been made public before this article.

++++++++++++++++++++++++++

It was previously mentioned (Episode 19) that the “exclusivity” clause in the MOU required that all work prospecting financial companies stop from the date the MOU was signed on July 6, 2012, for 60 consecutive days.

However, because the secret gaming committee was working with key staff at Innovation PEI [Melissa MacEachern, Cheryl Paynter] – but apparently not involving the Board of Directors in decision-making, it is uncertain whether Innovation PEI staff recruiting financial companies were ever properly informed about the exclusivity clause in the MOU, as I noted in episode #19:

“Regardless of whether the Board approved – or were even aware of – the MOU, it impacted Innovation PEI’s work. Once the MOU was signed on July 6, 2012, all recruiting and prospecting work by the Prospecting & Innovation Programs Division of Innovation PEI had to stop. That was problematic since some of those financial services recruitment efforts had commenced long before the signing of the MOU.”

“Given the secrecy and unusual way the MOU came into effect, it’s unclear whether other government staff who may have been working on prospecting financial services companies to PEI were even made aware of the MOU. Were they informed that the PEI Government was to have absolutely no discussions with any other financial companies, or even mention that the Government had an interest in establishing a financial transaction hub in PEI? Nothing about the companies, the plan to bring a financial transaction hub to PEI, or the MOU with FMT, was mentioned in Innovation PEI’s 2012-13 Annual Report.”

As it turns out, Brad Mix had indeed been communicating with a financial services company prior to the MOU being signed attempting to recruit the company to PEI to establish a financial services centre, and he kept communicating after the MOU was signed. We’ll get into all of that shortly, but first a bit about how Paul Maines came to know about RBC [the THIRD TRAIN] – given the fact that Jonathan Coady withheld all those documents from the Court, and would not agree to have them entered into the record even after CMT acquired them through a FOIP.

The Rules of Court require both Parties to consent to new material being submitted to the Judge after Motion Hearing, so even though CMT’s lawyer had the documents, he was blocked by Coady from having Campbell consider them, just as he was prevented from providing Campbell with the damning documents Coady served him on September 20, 2019, which just so happened to be the same day the Information Commissioner issued Orders compelling the Government to produce those records, so Coady may have learned the Government would not be able to withhold them much longer.

How Paul Maines Came to Know about RBC Dexia

Absolutely nothing was produced by Jonathan Coady regarding what you are about to read. Maines and his lawyer were, until recently, kept completely in the dark about the PEI Government’s recruitment efforts with RBC Dexia, a 100%-owned subsidiary of the Royal Bank of Canada.

Maines had submitted a FOIP request to the Department of Economic Growth, Tourism and Culture on May 14, 2019, for the following: The Department started processing the request on May 23rd and delivered responsive records to Maines on July 23, 2019.

The Department started processing the request on May 23rd and delivered responsive records to Maines on July 23, 2019.

Armed with both (1) the July 10th letter from Deputy Minister Erin McGrath-Gaudet proving that Coady failed to disclose information about 2 years of missing records from Mix, and (2) new FOIP documents confirming that ongoing recruitment efforts attempting to bring RBC to PEI were happening when the MOU was in effect, CMT’s lawyer immediately sent a letter to Jonathan Coady requesting his consent to have these new documents disclosed to Judge Campbell. MacDonald also asked Coady to remove himself from the case, for failing to produce those records and information about Mix’s missing records: Coady declined to either remove himself from the case or to bring the “…breach of various disclosure rules…” to the attention of Justice Campbell. As a result, Campbell never considered any of the documents recently filed with the PEI Court of Appeal as a Fresh Evidence Motion by CMT.

Coady declined to either remove himself from the case or to bring the “…breach of various disclosure rules…” to the attention of Justice Campbell. As a result, Campbell never considered any of the documents recently filed with the PEI Court of Appeal as a Fresh Evidence Motion by CMT.

No mention of this major new revelation (that goes to the very heart of the coverup of the breach of the MOU by the PEI Government and the Justice system) has yet been made by any of PEI’s so-called “mainstream” media (CBC, Guardian, Journal Pioneer, and Eastern Graphic).

Given the legal implications of this new evidence, I again want to let the documents speak for themselves as much as possible, with only a minimum amount of commentary to fill in some gaps, or further explain what is said in the various email documents.

I’ve taken all the relevant emails and organized them chronologically, so you will be able to see clearly how the recruiting efforts with RBC pre-dated the signing of the MOU with FMT, and how it continued through both the initial 60-day MOU (signed July 6, 2012) and 30-day extension of the MOU (signed September 10, 2012).

Brad Mix’s Recruiting Efforts with RBC Dexia

Prior to the MOU signing on July 6, 2012, Brad Mix had been working on what I’m sure he was hoping would be the recruiting “score” of his prospecting career – RBC Dexia.

When it comes to large-scale corporate recruitment schemes, there’s been no shortage of boondoggles and white elephants in PEI’s history. When Brad Mix suddenly caught the attention of a reputable and “low-risk” financial company in early 2012, RBC Dexia, it must have seemed to Brad Mix that he had struck the recruitment “motherlode” with his efforts to prospect a major financial sector company to PEI. RBC Dexia was being solicited by Mix to establish a Financial Services Center in PEI to “export” financial services globally, with a projected staff of up to 600 employees.

Maine’s FOIP had requested documents from May 1, 2012, but somehow was also provided several emails in the thread from March 2012. The first email had a subject line reading: “Re: Follow up to PEI presentation to RBC Dexia,” however, I don’t have access to what that presentation entailed. Mix was responding to an email he had received earlier that day from Karl Barrow, who was handed the file from Joanna Meager, the person Mix had been dealing with at RBC Dexia: Mix responded the same day with the following:

Mix responded the same day with the following: The following week, Mix sent Barrow this email:

The following week, Mix sent Barrow this email: We here learn that Mix had met with Joanna in London on March 2, where RBC Dexia locating in PEI was discussed, with a projection that the number of positions created could possibly be 600 after 3 years. There was some back-and-forth communications between Barrow and Mix, with a clarification of the recruitment offer with more details from Mix, including an updated presentation based on significantly increased numbers (e.g., 600 after 3 years):

We here learn that Mix had met with Joanna in London on March 2, where RBC Dexia locating in PEI was discussed, with a projection that the number of positions created could possibly be 600 after 3 years. There was some back-and-forth communications between Barrow and Mix, with a clarification of the recruitment offer with more details from Mix, including an updated presentation based on significantly increased numbers (e.g., 600 after 3 years): Barrow responded three days later saying “that’s fine,” and also informed Mix that he was going on vacation for two weeks:

Barrow responded three days later saying “that’s fine,” and also informed Mix that he was going on vacation for two weeks: Mix counted the days until Barrow’s vacation was over, then contacted Barrow to see if he needed any further information concerning what RBC could expect by way of labour rebates, tax benefits, etc. to locate on PEI.

Mix counted the days until Barrow’s vacation was over, then contacted Barrow to see if he needed any further information concerning what RBC could expect by way of labour rebates, tax benefits, etc. to locate on PEI. Barrow’s response came the same day:

Barrow’s response came the same day: Maines obtained another email from a different FOIP request dated June 2, 2012 (also included in CMT’s Fresh Evidence Motion) with some redactions. It was an email that Brad Mix had sent to Neil Stewart about his upcoming scheduled meetings with 10 different financial services companies in Toronto in June 2012, one of which was RBC Dexia:

Maines obtained another email from a different FOIP request dated June 2, 2012 (also included in CMT’s Fresh Evidence Motion) with some redactions. It was an email that Brad Mix had sent to Neil Stewart about his upcoming scheduled meetings with 10 different financial services companies in Toronto in June 2012, one of which was RBC Dexia: Whatever that “program” was, Mix believed it was “needed to attract a financial services opportunity to PEI.” This recruitment escapade to Toronto happened a couple of weeks before the MOU was signed. As you will soon see, the meeting that Mix had with RBC Dexia in June 2012 wasn’t the last communication he had with RBC Dexia, even after the MOU was signed.

Whatever that “program” was, Mix believed it was “needed to attract a financial services opportunity to PEI.” This recruitment escapade to Toronto happened a couple of weeks before the MOU was signed. As you will soon see, the meeting that Mix had with RBC Dexia in June 2012 wasn’t the last communication he had with RBC Dexia, even after the MOU was signed.

The next email mentioning RBC Dexia comes – ironically – on July 6, 2012, THE SAME DAY THE MOU WITH FMT WAS SIGNED BY CHERYL PAYNTER! That July 6th email from Brad Mix didn’t mention the MOU with FMT, nor the exclusivity clause in the MOU forbidding any discussions with any other financial services company regarding PEI’s interest in hosting a financial services centre. Brad was providing an “RBC Dexia Status” update to Wes Sheridan, Allen Roach, Melissa MacEachern, which was also copied to Cheryl Paynter, ON THE SAME DAY SHE SIGNED THE MOU WITH FMT.  Wes Sheridan was planning to meet with John Lockbaum at RBC in meetings scheduled in Toronto in mid-July. RBC Dexia was in the process of being acquired by RBC, so Mix was providing Sheridan with background information, informing him that RBC acquiring RBC Dexia shouldn’t be a problem (since Mix had been assured by Joanna Meager that RBC Dexia would be making the decisions on the PEI deal).

Wes Sheridan was planning to meet with John Lockbaum at RBC in meetings scheduled in Toronto in mid-July. RBC Dexia was in the process of being acquired by RBC, so Mix was providing Sheridan with background information, informing him that RBC acquiring RBC Dexia shouldn’t be a problem (since Mix had been assured by Joanna Meager that RBC Dexia would be making the decisions on the PEI deal).

Perhaps more importantly, Mix wanted Sheridan to know that Lockbaum may not know anything about the possible PEI deal with RBC Dexia and that it might be prudent for Sheridan to get a sense of whether RBC is envisioning a different future for Dexia. Wes appreciated the advice:

On July 10, 2012, just 4 days after the MOU was signed, Cheryl Paynter forwarded an email to her boss, Melissa MacEachern, that Brad Mix had sent to her on February 24, 2012 – the same day the Government supposedly ended the e-gaming project. That email raised concerns about Simplex’s CEO, Philip Walsh, which Mix had apparently heard from someone claiming to have founded Simplex: What prompted Paynter to dig up that old email and send it to MacEachern? That is not clear. Two days later, and just hours before Sheridan’s meeting with RBC in Toronto, he contacted Mix asking whether there had been any further communication or new information on RBC Dexia that he should be aware of before his meeting with Lockbaum:

What prompted Paynter to dig up that old email and send it to MacEachern? That is not clear. Two days later, and just hours before Sheridan’s meeting with RBC in Toronto, he contacted Mix asking whether there had been any further communication or new information on RBC Dexia that he should be aware of before his meeting with Lockbaum: Mix’s response?

Mix’s response? On July 18, 2012, Mix sent the following email to Cheryl Paynter:

On July 18, 2012, Mix sent the following email to Cheryl Paynter: Mix is obviously referring to the meeting Paynter had with FMT on the 6th when the MOU was signed – Paynter did not meet with Simplex. Paynter responded with the following totally unbelievable comment, telling Mix that an agreement was signed but that it was “non-binding.” Paynter mentioned nothing about the very strict legally-binding “exclusivity” clause:

Mix is obviously referring to the meeting Paynter had with FMT on the 6th when the MOU was signed – Paynter did not meet with Simplex. Paynter responded with the following totally unbelievable comment, telling Mix that an agreement was signed but that it was “non-binding.” Paynter mentioned nothing about the very strict legally-binding “exclusivity” clause:

The following day, Mix provided an RBC Dexia update to his own Minister (Allen Roach) and Cheryl Paynter (CEO of Innovation PEI at the time), with very favorable and hopeful comments about the prospects of RBC locating in PEI:

The following day, Mix provided an RBC Dexia update to his own Minister (Allen Roach) and Cheryl Paynter (CEO of Innovation PEI at the time), with very favorable and hopeful comments about the prospects of RBC locating in PEI: Mix indicated that “PEI is still being considered for a nearshore location” by RBC Dexia. The last sentence in his update makes it clear that RBC was being actively “solicited” to come to PEI: “Full package to be completed within 3 weeks in anticipation of a site visit.”

Mix indicated that “PEI is still being considered for a nearshore location” by RBC Dexia. The last sentence in his update makes it clear that RBC was being actively “solicited” to come to PEI: “Full package to be completed within 3 weeks in anticipation of a site visit.”

After RBC Dexia issued a News Release about its successful corporate rebranding as a subsidiary of RBC, Mix expressed his excitement with the prospect that RBC Dexia might be coming to PEI, and immediately forwarded that News Release to Roach, Sheridan, Paynter, and MacEachern with the enthusiastic proclamation: “Our number one prospect…..introducing RBC Investor Services….” like he was the Master of Ceremonies at a “Recruits of the Year” awards ceremony.

Number one prospect? So much for the promise made in the Recruitment Package to grant FMT “first-mover advantage” by establishing a financial transaction platform other corporate clients would then rely on for transaction services.

One paragraph of the News Release clarified that RBC Dexia – renamed “RBC Investor Services” – was a “…premier provider of investor services to asset managers, financial institutions and other institutional investors worldwide.”  Mix completed the details of the recruitment package sent to RBC; scheduled a “site visit” with RBC Investor Services for September 20, 2012, and prepared a PowerPoint Presentation for the meeting, a copy of which was included in the FOIP documents obtained by Maines:

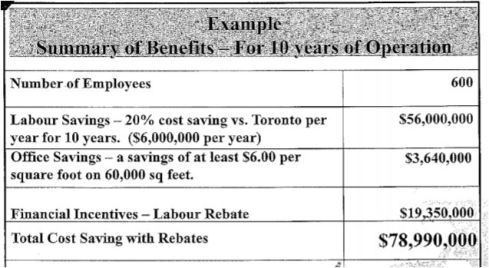

Mix completed the details of the recruitment package sent to RBC; scheduled a “site visit” with RBC Investor Services for September 20, 2012, and prepared a PowerPoint Presentation for the meeting, a copy of which was included in the FOIP documents obtained by Maines: The total offered to RBC at that presentation by way of rebates and financial incentives was significant ($19, 350,000):

The total offered to RBC at that presentation by way of rebates and financial incentives was significant ($19, 350,000): Mix calculated the benefits to RBC over a ten year period as well ($78, 990,000):

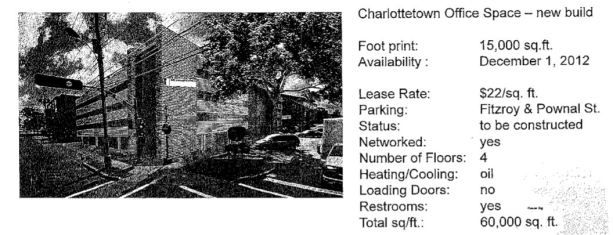

Mix calculated the benefits to RBC over a ten year period as well ($78, 990,000): But to show just how committed (and ambitious) the PEI Government was to have RBC establish a Financial Services Centre in PEI, it offered a brand new building that was still in the “dream” stage. Although the ground hadn’t yet been broken, the “availability” date for the new complex was listed as December 1, 2012, just a little more than two months after the date the offer was made:

But to show just how committed (and ambitious) the PEI Government was to have RBC establish a Financial Services Centre in PEI, it offered a brand new building that was still in the “dream” stage. Although the ground hadn’t yet been broken, the “availability” date for the new complex was listed as December 1, 2012, just a little more than two months after the date the offer was made:

Do I have to state the obvious from the documentary evidence? The PEI Government appears to have broken the MOU not once (with Keith Laslop/Newco) but at least twice (with RBC Dexia). Jonathan Coady refused to consent to have any of these RBC documents provided to Judge Campbell. In the September 6, 2012, Case Management Conference Call meeting, when CMT’s lawyer argued he had new materially-relevant documents that should be considered, Judge Campbell indicated he didn’t want to see them and ruled he would accept no more documents.

Why Three Trains for one Hub?

I don’t usually venture into the realm of “speculation” in my writings about the e-gaming scandal and CMT lawsuit. When I do, I’m very careful to point out the distinction between documentary evidence and possible scenarios that – although not yet proven with documentary evidence – are strongly suggestive. If nothing else, such exercises often open up new avenues for further investigation.

It took me a while to figure out why the Provincial Government would be simultaneously “recruiting” two different companies (Newco and RBC) to fill the space that was to be occupied by FMT. I have previously argued that unlike some economic sectors, there isn’t space for two “financial transaction hubs” in PEI. That’s why Jessop wrote the “exclusivity clause” so broadly to include any “financial services centre.”

Was RBC Dexia a “financial services” company being recruited to establish a financial transaction “hub” or centre in PEI? Of course, it was. It wasn’t looking to service local customers in PEI, the vision of 600 employees confirms a financial transaction “hub” venture serving global clients.

Was RBC Dexia a “financial services” company being recruited to establish a financial transaction “hub” or centre in PEI? Of course, it was. It wasn’t looking to service local customers in PEI, the vision of 600 employees confirms a financial transaction “hub” venture serving global clients.

And here’s my theory. When Rory Beck was Clerk of Executive Council, prior to his sudden and untimely death, he was obviously excited about the prospects of bringing a financial services centre to PEI. He seems to have had, on the other hand, no interest whatsoever in the “gaming” side of that plan, especially the secrecy side of it.

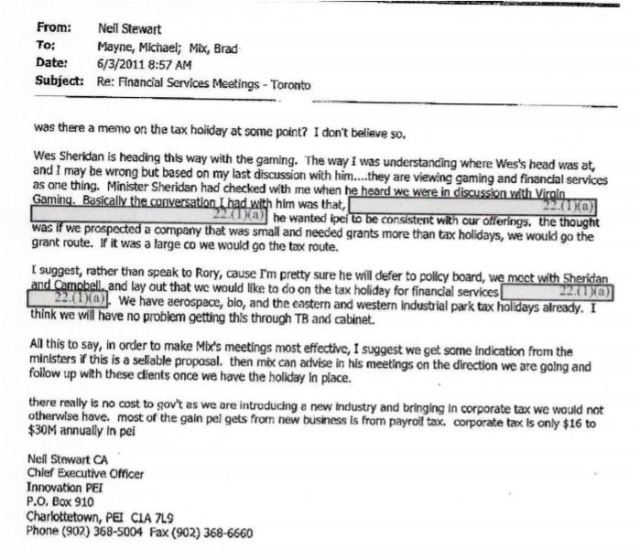

Beck’s reputation for “doing things by the book” jeopardized the secrecy status of the entire gaming initiative, so it wasn’t uncommon for those involved in the gaming initiative, like Neil Stewart, to avoid Beck and find other ways to achieve their ends. For example, when Mix was going to meet financial companies in June 2012 in Toronto, Neil Stewart was trying to get clarification on what Mix could offer by way of a “tax holiday”. There are some redacted parts to the email, but read what Stewart says about Rory “deferring to Policy Board” (aka “doing the right thing”):

Wes Sheridan and Neil Stewart avoided Rory Beck because they knew he was a person who would follow Treasury Board policy and not skirt the law, which was a secret e-gaming committee “no-no”, operating as it was “outside the normal oversight framework of Government” as the Auditor General stated several times throughout her special e-gaming report.

Wes Sheridan and Neil Stewart avoided Rory Beck because they knew he was a person who would follow Treasury Board policy and not skirt the law, which was a secret e-gaming committee “no-no”, operating as it was “outside the normal oversight framework of Government” as the Auditor General stated several times throughout her special e-gaming report.

At any rate, the documentation clearly shows that Wes Sheridan, Chris LeClair, Billy Dow, Melissa MacEachern, and others, were hoping to get in on the ground floor of a “local” company delivering the financial transaction platform services for gaming clients.

At first, the plan was clearly to have CMT become FMT, with local investors and local people on FMT’s board. I suspect that after local investors like Billy Dow and Chris LeClair, etc., realized that CMT was never going to give up anything close to controlling interest in FMT (which CMT owned 100% of the shares) they figured they had learned enough about the industry by that time – mostly from 2 years of dealing with CMT/Simplex – that they believed they could cut FMT out of the picture and create their own local company to do the “gaming” side of the financial transactions. But Newco was not SWIFT-certified to handle financial payment transactions for gaming, so it would have to work out an agreement with the PEI Credit Union if that plan was to go forward.

Newco could get its own gaming transactions handled through the PEI Credit Union, but couldn’t offer the same SWIFT-certified platform that FMT could. Not only could it not take over that part of the “space” left vacant by removing FMT from the picture, but Newco would also have had to partner with a financial institution to acquire those transaction services for its own gaming purposes. How to fill that other space? Enter RBC Dexia.

The “one track” that the FMT Global transaction platform was going to occupy, suddenly became “two tracks”, with Newco (Train #2) handling the non-financial platform for payments processing and gaming, and RBC Dexia (Train #3) handling financial transactions.

Recall that Billy Dow was approached by Gary Evans – both of whom were investors in CMT – with news that CMT/FMT was considering establishing the Global Transaction Platform in another Atlantic Province. Dow responded by offering a MOU that gave FMT “exclusive” rights to negotiate with the PEI government to establish the financial hub in PEI. That MOU was signed on July 6, 2012, but the following week Cheryl Paynter tells her colleagues actively recruiting another financial services company that the MOU was “non-binding.” Subsequently, Mix and Sheridan carried on with work to recruit RBC to establish a financial services centre in PEI.

If PEI had honoured its promise made to FMT that it would have a “first-mover advantage” once a major gaming client for the hub was secured (which Maines delivered in the Spring of 2011 when he recruited “Virgin Gaming”) then the PEI Government would not have been recruiting RBC even before the MOU.

As far as CMT/FMT knew, things seemed on track with that promise being fulfilled, especially after the MOU was signed on July 6, 2012. We can now see from the documents that were hidden and kept from the Court, that the PEI Government never stopped recruiting RBC, nor paid any serious attention to the legal requirement to deal exclusively with FMT.

In the above email from Mix to Paynter, you wonder if either of them really grasps what’s going on – Cheryl put “Simplex” on the email subject line, but Simplex had nothing to do with the MOU. You also have to wonder what Billy Dow really told MacEachern and Paynter about the MOU. It’s starting to look like he totally downplayed the “risk” to the PEI Government with the four binding clauses in the MOU. Even the Auditor General drew attention to the fact that Dow said those legally-binding provisions were “relatively benign” just before she proceeded to explain why they were very risky, not typical for the Government to enter into with companies, and would potentially be very costly for the province if the MOU was breached.

I now believe I understand what was most likely going on behind the scenes. The ‘gaming’ group (Sheridan, LeClair, MacEachern, Paynter, Scales, Kiley, O’Brien, Stewart, and Mix) worked together to get both Newco and RBC. They planned to let the MOU with FMT expire and (a) had already done the prep work with Keith Laslop and Chris LeClair to have a proposal submitted on the same day they thought the MOU was expiring on September 6, 2012, and (b) had prepared a recruitment package for RBC with an on-site visit and presentation scheduled for September 20, 2012.

Everything would likely have transpired as planned if Paul Maines had not become aware of the Laslop/Newco part of the plan, which forced Innovation PEI to grant an extension of the MOU. There were no legitimate reasons for Innovation PEI not to have concluded that deal with FMT, and that would have happened if not for the Securities Investigation that derailed the FMT train. Keep in mind, once a deal was inked with FMT, RBC Dexia would have had to have been a client on the Global Transaction Platform.

The next episode will revisit the issue of how the PEI Securities Commission investigation initiated by Dowling came to happen, with some shocking new revelations that should put the final nail in the coffin for the PEI Government Defendant’s claims that they did not act with misfeasance.