Episode #22: Why did Brad Mix go to Osaka, Japan? (Part II)

![]()

PREAMBLE

With just 4 episodes remaining in this 25-part series, I want to make them count. If you’ve been following this docu-series on Judge Campbell’s ruling to dismiss CMT’s lawsuit and forbid a new claim from being filed, then you’ll know that previous episodes have already provided indisputable evidence of errors in Judge Campbell’s decision.

In fact, there’s so much accumulated evidence, it’s hard to keep track of just how much evidence there is. Consequently, my final episode in this series (#25) will provide a summary list of findings that challenge Campbell’s interpretation of the facts and disprove his conclusions supporting his decision to dismiss CMT’s lawsuit so emphatically and completely.

With the Dennis King government having to file a response to CMT’s PEI Court of Appeal case in less than a week (January 6, 2020), we’ll soon see whether the PC Minority government will dare to attempt to argue there are no “triable” issues. If it does, it will be telling for sure; especially given the persistence and force in which the PC Party MLAs (now members of Cabinet) argued so fiercely as the Official Opposition that a number of major issues demand the scrutiny of a trial. Issues including: (1) multiple instances of the wanton destruction of government records; (2) a completely bogus Securities Investigation, initiated despite there never being an official complaint from anyone [one of the remaining 3 episodes]; and (3) what the PC Party declared in the Legislative Assembly to be clear evidence of a breach of the MOU, with the Keith Laslop/Newco documents which the PC Caucus uncovered in an e-gaming FOIP.

For this government to defend Judge Campbell’s ruling would represent a complete “about-face” on the issue. Such a position would be hard to justify, and to many, it would be viewed as complicity in the previous Liberal Government’s e-gaming cover-up strategy, not to mention a glaring failure to deliver on the King Government’s promise to deliver full transparency and due process. Whatever is filed next Monday will be owned by this government, not the MacLauchlan government, not the Ghiz government.

These issues raise the basic question: “Does our Justice system need to know the truth to rule justly?” and strikes at the heart of what it means to live in a free and just society. Such a society demands that the PEI government ensure that the fundamental principles of natural justice which are enshrined in the Canadian Constitution – and which are absolutely essential for a system of parliamentary democracy such as ours to function effectively, and ethically, in the service of truth and justice – are protected, upheld, and not allowed to be undermined.

There is a growing number of influential people becoming aware of the travesty of justice that has been unfolding (and getting worse) since CMT and Paul Maines were first subjected to a targeted and totally unwarranted PEI Securities Investigation in September 2012. There are now approximately 1,000 dedicated followers of this investigative series, with that number growing with each new episode.

I’m very encouraged to know that retired Supreme Court Justices are paying close attention, National Investigative News Agencies are staying updated, waiting for more to unfold (e.g., rulings from the Information and Privacy Commissioner; what happens at the upcoming Appeal Hearing, now scheduled for May 2020), federal parliamentarians, PEI MLAs, senators, lawyers, etc., are all following this sorry saga of secret shenanigans and self-serving strategizing with great interest. I know this because I’ve heard directly from many of them, and indirectly from others who have shared information about their conversations with many of those individuals.

The evidence presented in previous episodes already far exceeds the threshold required to warrant a trial. The remaining episodes will add to that body of evidence, but more importantly, they will more clearly reveal the length, breadth, and depth of the cover-up strategy that has been employed over the years to hide the truth about what really happened from everyone other than those involved, apparently, even the Court, as more information and many more records become public through targeted FOIP requests due to produce records in coming weeks.

It appears Campbell never intended to let this case go to trial. At a minimum, he knew that a lot of information was being withheld from the Court by Counsel Coady. Two years of unexplained Brad Mix records gone missing were of no consequence to Campbell whatsoever, since he had already determined that they were documents from before the MOU time period and that FMT had no involvement with the “so-called” e-gaming project (as Campbell referred to it) nor Maines, nor the PEI Government any time prior to the summer of 2012 when the MOU was signed. The findings from the Auditor General completely contradict Campbell’s reasoning, of course, and countless new documents also shatter that view, which has been completely and extensively proven false in previous episodes.

When Maines and CMT obtained new FOIP documents prior to Campbell’s ruling on September 25, 2019, Coady refused to consent to have those materially-relevant documents entered into the Court Record for Campbell’s benefit. When CMT’s lawyer brought the matter up in a Case Management Conference call, Campbell ruled that he would not consider any new documents, despite CMT’s lawyer insisting on their key importance, and actually expedited filing his decision.

In retrospect, it appears Campbell may have realized that the decision he had drafted to dismiss the case would need to be significantly altered – with a different conclusion regarding whether there were any “triable” issues – if he was to consider those new documents. By closing the gate, the full onus for refusing to file materially-relevant documents immediately fell to Jonathan Coady.

Coady may have allowed himself to be precariously positioned “under the bus” by Campbell, as they say. I’m at a loss to know what to expect with Coady’s filing on January 6th. To me, it’s one of those “no good answer” scenarios for Coady.

Will he argue he was kept in the dark by his own clients, and attempt to throw the PEI government under the bus? Or will he perhaps argue that the onus was on CMT to “take legal measures” to “force” them to comply with the Rules of court and release documents they will continue to argue are not materially relevant? It’s one of those “wait-and-see” moments in this long and bizarre saga.

And will Coady mention any of the new documents which he kept from Campbell’s eyes? Especially those records that are particularly damaging to the Government’s case? If the lawyers had been aware of how Coady refused to produce countless materially-relevant documents, in contravention of the Rules of Court, I wonder whether they would have still voted him the 2020 Civil Litigation Lawyer of the Year?

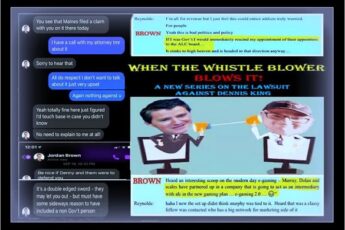

That’s why Campbell’s picture isn’t in the graphic for this episode. Campbell never saw the new important documents about Brad Mix’s trip to Osaka, Japan that Paul Maines obtained in a FOIP just before Christmas.

This episode examines some of this new information under the following headings:

- More Fruits from CMT’s “FOIP” Strategy. Looks at how the new documents were finally made available to Maines under a Court-enforced Order from the Information and Privacy Commissioner;

- Campbell’s Ruling that Mix did not Breach the MOU: Some of this was dealt with in Episode #13; however it is being presented again in part to highlight the exact nature of the basis for Campbell’s ruling on this matter.

- Revisiting the “Exclusivity Clause” looks at the literal and normal meaning of the words, especially the phrase “hosting or creating a financial services centre”; and

- The Smoking Gun: Two new documents made public in a December 18, 2019 FOIP (which Paul Maines shared with investors, media, etc.) which reveal the manner in which Mix, on behalf of Innovation PEI and the PEI Government, breached the MOU.

+++++++++++++++++++++++++++

1. More Fruits from CMT’s “FOIP” Strategy

Recall that the 2 years of Brad Mix’s documents generated during the e-gaming/financial transaction platform project period (Fall, 2010 – Fall, 2012) mysteriously “went missing” in not one, but TWO of Mix’s email archives.

That important piece of information was kept secret and wasn’t known at the time when CMT’s lawyer cross-examined Brad Mix last January 2019. I mentioned in a previous episode that when John MacDonald, CMT’s lawyer, asked Mix if he had produced all his records at cross-examination, Coady jumped in to answer for Mix, saying: “I believe so.”

Well, six months later, as a result of my Brad Mix review with the information Commissioner, we learned in a July 10, 2019 letter from Deputy Minister McGrath-Gaudet to the Information Commissioner that Mix had confessed about those two years of missing records for the first time. That’s also when I realized I had been strung along with lie after lie about those missing records since I filed my request in October 2018!

Recall, as well, that a number of the communications of significance during that period of time were between Paul Jenkins (representing FMT) and Mix, and that Jenkins also claimed to have been “hacked” and had the same 2 year time period of records mysteriously go missing.

Knowing that materially-relevant documents had existed at one time, Maines sought out those records – and found a good number of them – in the inboxes of other government employees. If not for this unprecedented (and what should have been an unnecessary FOIP strategy) this case would likely be a dead issue by now, with no documented grounds to challenge Campbell’s ruling to dismiss. That’s not how things are turning out.

Things are now exploding in a way that will continuously reveal more and more about what has been an unprecedented and carefully-choreographed attempt by literally dozens of people, who are, each in their own way, complicit in the coverup of a deliberate attempt to thwart both democracy and justice. The shroud used to obscure the truth is now rapidly unraveling, thread by thread. This episode represents another thread-pulling exercise in that shroud-shredding process.

On December 18, 2019, Paul Maines received an early Christmas present – 187 pages of documents from a FOIP request filed last May. Those documents were in response to the following request for Government records:

Before getting into what was contained in those 187 pages the Information Commissioner ordered the PEI government to release, it’s important to first revisit Campbell’s ruling on Brad Mix’s attendance at the SIBOS conference, especially the time-scope of the documents that he had before him to consider, along with the essential structure of his legal argument concluding no breach occurred with Mix going to Osaka, Japan.

2. Campbell’s Ruling that Mix did not Breach the MOU

You may recall from Episode #13: Why Did Brad Mix go to Osaka, Japan? that Judge Campbell dismissed CMT’s claim against Mix that he violated the Memorandum of Understanding (MOU), that Innovation PEI had signed with FMT, by attending a “SWIFT” conference in Osaka, Japan in October 2012.

Paragraph 290: On October 15, 2012, Mix was advised by their matchmaking consultant that they had arranged a meeting between Mix and Kaflon of Sterci. Mix advised Paynter and asked if he should decline the meeting. I note again that the email respecting a future meeting was sent 5 days after the final expiration of the MOU. Mix did meet with Kaflon at the SIBOS conference and expressed in his travel summary that he felt Sterci had no interest in following up on his invitation to invest in PEI.

Campbell pointed out that any meetings held at the SIBOS conference were also when the MOU had expired.

Paragraph 287: Once again, it is important to note that the SIBOS conference took place approximately three weeks after the MOU expired for the second and final time.

He presented his interpretation and understanding of what Mix was doing at SIBOS on behalf of Innovation PEI as work undertaken in the “ordinary course of business.”

With the “Exclusivity Clause” in effect, there was no “ordinary course of business” available to Innovation PEI with respect to recruitment in the financial services sector during the time when the MOU was in effect.

I will not repeat here what I presented in Episode #21: Covering up the Breach of the MOU (Part 1) with a section titled “3. The Negative Impact on Innovation PEI from the “Exclusivity Clause”, beyond restating what the Auditor General identified as a concern that senior staff at Innovation brought to her attention regarding the impact of the MOU on their work:

Section 5.11: Further, clarification on the terms and conditions in the agreement was not obtained. This was particularly important for Innovation PEI because the wording of the exclusivity section was very broad. Financial service was a key sector identified by Innovation PEI for economic development in the province. Innovation PEI senior officials advised that they were concerned about the exclusivity clause and how it would impact their work.

Having dismissed any meetings that took place at SIBOS as having any significance – since they happened outside the time period the MOU was in effect – Campbell then also considers the communications between Mix and HMC Global, which he knew would have happened during the time the MOU was in effect. He concludes that no evidence was provided to HMC Global by Mix breaching the MOU in those communications:

Paragraph 281: Mix used the services of HMC Global, a corporate matchmaking service, for the purpose of arranging meetings for Mix to introduce PEI as a near-shore location in North America for business investment. Neither Mix or anyone else at Innovation disclosed any information regarding CMT, 764, Maines or Walsh to HMC Global when it was arranging meetings for Innovation.

He further concludes there was no evidence that Mix “discussed any interest of Innovation PEI or the Government in establishing a financial services centre on PEI.”

Paragraph 295: I accept the evidence of Mix that he attended the SIBOS conference at the invitation of Walsh, and that he did not hold himself out to be a financial services expert. I also accept his evidence that his purpose was to introduce people to PEI and to invite them to consider PEI as an opportunity for business investment. I find there was no evidence presented showing he disclosed any confidential information or discussed any interest of Innovation PEI or the Government in establishing a financial services centre on PEI. Finally, once again, I note the SIBOS conference was held weeks after the final expiration of the MOU.

Paragraph 298: The defendants have met the onus upon them of showing that Mix did not use or disclose any proprietary or confidential information of the plaintiffs, or of Simplex, gained through the MOU or otherwise, or have any discussions prohibited by the MOU, or improperly have discussions with or recruit any potential clients of the plaintiffs. In doing so, the defendant Mix has shown there is no genuine issue requiring a trial regarding the allegations against him. With that, the onus shifted to the plaintiffs to show through evidence or argument that their claims against Mix have a real chance of success. The plaintiffs have failed to satisfy that onus.

Once again, Campbell is revealing either his ignorance about what a financial services centre and SWIFT-accredited platform are, or he is being willfully blind about what he actually knows. With first-mover advantage and the Simplex Global Transaction platform capabilities, every single financial services company that was approached on behalf of Brad Mix by HBC Global was a “potential client” of the plaintiffs. With “first-mover advantage,” FMT would have been providing SWIFT connectivity (along with a range of other services such as messaging, claims processing, etc.) to other SWIFT-based companies relocating in PEI which would have been clients of FMT.

The Simplex/Sterci Global Financial Transaction Platform was adopted by HSBC – the biggest bank in the world – which was announced at SIBOS in 2010. It’s as if Campbell doesn’t get it, or doesn’t want to get it, when it comes to understanding what FMT/CMT/SIMPLEX/Sterci were, and the interrelated nature of the global platform these companies were together offering with SWIFT connectivity, Claimatrix, and much more:

3. An Updated Response to Campbell’s Ruling of “No Breach”

Campbell states in paragraph 295, “I accept the evidence of Mix that he attended the SIBOS conference at the invitation of Walsh.” I’ve already dealt with this issue in Episode 13, showing how ridiculous it was for Campbell to have drawn that conclusion when the documentary evidence clearly shows that Walsh pretty much went ballistic when he learned from Kaflon at Sterci that Brad Mix was planning to attend SIBOS in Japan on his own. Even more baffling was Mix’s interest in meeting with Sterci, SIMPLEX’s partner, while he had completely kept FMT/Simplex in the dark about his attendance at SIBOS and his efforts to recruit other financial services companies to PEI.

In reviewing documents for this episode, it occurred to me that Judge Campbell – in a blatant case of biased cherry-picking – cited Gary Jessop’s (CMT’s lawyer’s) October 23, 2012 email to Billy Dow, but only a short segment where Jessop seems understanding (and even supportive) of Mix attending SIBOS:

Paragraph 282: The MOU had fully expired on October 10, 2012. On October 23, 2012, Jessop wrote to Dow acknowledging that 764 did not have the right to prevent Mix or the Province from meeting with anyone, and stating they were not trying to prevent Mix from doing his job but felt it would be in everyone’s best interest for them to have a discussion prior to him leaving for the SIBOS conference.”

Campbell would have presented a far more accurate picture of Jessop’s communication with Dow if he had cited him in true context. Jessop had listed a number of serious concerns in his lengthy letter to Dow – including the Securities Investigation – but noted that it was Brad Mix attending SIBOS on his own steam that was most concerning, since he had no expertise and went without sharing that information with Trinity Bay (FMT) and SIMPLEX. The potential damage that could easily have been caused to the business relationship between FMT and the PEI Government was a legitimate worry since many of the companies at SIBOS knew about the potential deal with PEI and CMT/Simplex. As Jessop explained:

“Trinity Bay and SIMPLEX had invited the Province to attend the SIBOS conference held in Toronto last year but were told that SIBOS was not a conference the province usually attends. If Brad has plans to attend this conference for several months, we have a concern as to why we were not advised during our meetings over the summer, especially that we openly discussed the importance of SIBOS to us. If the decision to attend SIBOS has only recently been made, we have a concern that Brad may be approaching the wrong people, including our competitors.” [Gary Jessop to Billy Dow, October 23, 2012].

Why all the stealth?

Of even greater interest is the fact that Cheryl Paynter did not know Brad Mix had registered for SIBOS in May, yet Mix noted in his communication with HBC that he had decided to attend “after several recommendations.” If his boss didn’t know about it until mid-August when Mix sought approval to travel to SIBOS, who gave Mix the recommendations?

Also, notice that the dates on all the SIBOS-related documents which Campbell referred to in his ruling are outside the time when the MOU was in effect:

[Paragraph 280] The exhibits attached to his affidavit included an email exchange in May 2012, with the organizers of the SIBOS conference in which they asked Mix for the name of his SWIFT contact person in order to gain approval from SWIFT for his registration to be processed.

[Paragraph 282] The MOU had fully expired on October 10, 2012. On October 23, 2012, Jessop wrote to Dow… [Paragraph 283]: On October 24, 2012, in the week prior to the SIBOS conference, Walsh emailed Mix saying: [Paragraph 288]: Mix also addressed the content of an email sent on October 15, 2012, from Simon Kalfon CEO of Sterci, to Walsh.Campbell is clearly aware that Mix would have had ongoing communications with the UK matchmaking company during the time of the MOU, but also rules that as not relevant, relying not on documents, but Mix’s sworn claims, and the absence of any documentary evidence or first-hand sworn testimony to refute those claims:

Paragraph 281: Mix used the services of HMC Global, a corporate matchmaking service, for the purpose of arranging meetings for Mix to introduce PEI as a near-shore location in North America for business investment. Neither Mix or anyone else at Innovation disclosed any information regarding CMT, 764, Maines or Walsh to HMC Global when it was arranging meetings for Innovation.

New documents now provide, I believe, incontrovertible evidence that the exclusivity clause of the MOU was indeed breached by Mix in his recruiting efforts during the MOU regarding his planned attendance at SIBOS.

I also believe Campbell would have been a lot more compelled to come to that same conclusion if he had the documents related to SIBOS dated within the MOU period, two of which are of particular significance: (1) An August 22 email from Brad Mix to the UK company exec; and (2) the September 18th contract signed between Innovation PEI and HMC Global.

Before examining those documents, it will be helpful to take another look at exactly what the “exclusivity clause” says, and why the Auditor General referred to it as having an undefined and very broad legal meaning and significant negative repercussions if breached.

3. Revisiting the “Exclusivity” Clause

Reading Campbell’s ruling on CMT’s claim that it has sufficient reason to believe Brad Mix breached the exclusivity clause of the MOU to go to trial can actually make you forget what it actually says, given Campbell’s propensity to ignore what it actually says, so it’s worth restating that particular clause and discussing what exactly it means:

(b) provided TBT is not in breach of its obligations hereunder, PEI nor any of its employees, officers, contractors, agents, representatives and/or professional advisors agrees not to discuss with any entity its interest and/or capabilities in hosting or creating a financial services centre in the Province.

Let’s unpack the meaning of what’s in red. “Not to discuss with any entity….” I think we can all agree that a UK company with extensive previous experience and knowledge of financial services companies attending SIBOS constitutes an “entity” as intended by the word in the clause.

The only remaining issue is whether Brad Mix, as an employee and agent of the PEI Government, had discussions with representatives of the Matchmaking company regarding its interest in“…hosting or creating a financial services centre in the Province” during the time of the MOU.

We’ve already noted above how Judge Campbell goes out of his way to note how discussions, or setting up meetings, or Mix attending SIBOS all happened outside the time when the MOU was in force. Well, consider the exclusivity clause in light of the following documents withheld from Campbell dated when the MOU was in effect.

4. The Smoking Gun

One of the new FOIP documents only released to Maines on December 18, 2019 was a contract that Brad Mix signed, on behalf of Innovation PEI, hiring a company in the UK to set up meetings at the SIBOS conference in Japan. That contract was signed and put into effect on September 18, 2012, when the MOU with FMT/Trinity Bay was still legally in effect. Mix’s communication with that UK company began much earlier.

On August 22, 2012, Brad Mix sent the following email to Gerard McCann at HMC Global in the UK.

Of special importance in this communication is that Brad Mix clearly identified the PEI government’s interest in enlisting support to set up meetings at a Global SWIFT conference – meetings scheduled during the MOU – with companies who were “…gateway providers using the SWIFT platform.” He goes on to say that he wants 8-10 meetings with these SWIFT based companies to provide “…a North American near-shore solution” in PEI.

This is evidence that Mix did indeed discuss PEI’s interest in hosting and creating a financial services centre in PEI. With more and more documents now becoming public – documents withheld from Campbell by Coady – what we’re witnessing isn’t a simple case of a couple of minor indiscretions or misunderstandings about the precise meaning of “financial services centre” in the exclusivity clause.

No, what we’re seeing is a growing paper trail documenting a well-orchestrated (but secret) effort to bring as many financial service companies to PEI throughout 2012 in a virtual “financial services company” recruiting frenzy that was already in high gear before the MOU was signed, and continued “full-steam ahead” both during, and following, the period the MOU was in effect.

Paynter – Mix’s boss – stated on a couple of occasions that the MOU was not legally-binding (without further explaining that the exclusivity and confidentiality clauses were, indeed, legally-binding) which may have led Brad Mix to believe he was free to carry on doing what Campbell referred to as Innovation PEI’s “normal course of business” of recruitment, while all the while ignoring the “spirit and letter” of the exclusivity clause, not to mention the good-faith intention of the MOU.

If you’re scouting on the other side of the world to recruit as many different global SWIFT-based financial services transaction companies in a vigorous and costly recruiting mission, then you are both selling PEI as a financial centre and attempting to build a financial services centre, and achieve more of that goal with the addition of every new successful financial services company recruited to PEI.

What is a Financial Services Centre exactly? Here’s what an online Business Dictionary offers by way of simple, straightforward definition of a Financial Centre:

“Financial Centre: City or its district (1) that has a heavy concentration of financial institutions, (2) that offers a highly developed commercial and communications infrastructure, and (3) where a great number of domestic and international trading transactions are conducted. London, New York, and Tokyo are the world’s premier financial centers.”

It is ridiculous to say that an attempt was made to target at least 8-10 SWIFT-based global financial services companies (with a high-end target of 15 meetings, 5 meetings per day at the 3-day SIBOS conference) to establish a “near-shore” presence in PEI, without at the same time admitting that such efforts require a disclosure of interest in establishing a financial services centre in PEI.

And this recruitment work was at one and the same time consistent with, and in addition to, many other similar efforts Mix was involved with to recruit financial services companies to PEI in 2012, including those discussed in previous episodes (Laslop/Newco; and RBC).

Not to get side-tracked, but another recruitment pursuit planned during the MOU that has never before been mentioned involved then Consul General Pat Binns. A trip was planned for October 2012 to Boston. This was revealed serendipitously in the same Brad Mix documents about the SIBOS conference.

Mix initially sent the same email request he sent to HBC Global for proposals for the SIBOS matchmaking contract to another company, Mark Healy Consulting. Healy did submit a proposal for the SIBOS work, but the SIBOS contract ended up going to HBC Global. However, Mix offered Healy another matchmaking contract for another recruitment mission to Boston, providing him with a list of 40 financial services companies for possible meetings.

No documents mentioning these recruitment efforts to Boston were produced by Coady.

What was suspected, but covered-up, is now crystal clear: although Innovation PEI signed an MOU that was supposed to, and legally-required to, end all discussions with other financial services companies about PEI’s interest in hosting and/or creating a financial services center, recruitment efforts that were underway at Innovation PEI continued, and even intensified, as meetings were sought with Global SWIFT companies at SIBOS, and North American financial service companies in Toronto and Boston as well.

The August 22nd email from Mix to the two companies he invited to submit proposals to do company matchmaking at SIBOS authorized HBC Global to contact companies for the purpose of communicating a PEI interest in having them establish a near-shore SWIFT-based financial services company in PEI. That is exactly what the exclusivity clause said the PEI government could not legally do during the time the MOU was in effect, and that’s exactly what Mix did.

Look at the graphic which the PEI Government used in its own 2015 promotion webpage concerning its understanding of “near-shore”.

Notice the “hub-like” nature of PEI sitting at the centre of the spokes.

Campbell somehow wants us to believe that Mix actively recruited numerous SWIFT-based companies to establish in PEI, in secret, but was able to do so without letting those companies that he was meeting with know that PEI was interested in hosting financial services companies, in fact, was interested in attracting numerous financial services companies, and thereby, with each successful “recruit”, would be further building a financial services centre in PEI for exporting near-shore financial services? That’s the exact language used in the targeted offer made to RBC financial (See Episode #21):

I’m sure similar terms would have been offered to the SWIFT-based Global financial services companies Mix was meeting at SIBOS if they had shown interest in locating to PEI. What he specifically wrote into “Schedule A” of the Contact with HBC Global as “guidance” for the Matchmaking work in Japan, was to focus on the “…highest potential financial services firms that are considering a business location in North America.”

I’m sure similar terms would have been offered to the SWIFT-based Global financial services companies Mix was meeting at SIBOS if they had shown interest in locating to PEI. What he specifically wrote into “Schedule A” of the Contact with HBC Global as “guidance” for the Matchmaking work in Japan, was to focus on the “…highest potential financial services firms that are considering a business location in North America.”

Summary

Would Campbell have read these new documents from within the MOU period in the same way that I have if they had been produced by Coady? How could he not have?

To me, the Auditor General was bang on – the legally-binding exclusivity clause was meant to shut down all financial services company recruitment until the finalization of a good-faith agreement with FMT. That agreement would have provided the SIMPLEX Global Transactions Platform and Claimatrix technology as the platform through which other financial service companies, gaming companies, loyalty card customers, etc. would then sign-on, with mutual benefits accruing to both FMT and the PEI Government.

The services FMT would have offered as a near-shore service platform based in PEI, and being negotiated as terms of the agreement almost completed before the bogus Securities Investigation – were the same kind of SWIFT transaction services, reconciliations services, message transformation, trade confirmation, and delivery services, and claims management services being provided by the companies Mix was recruiting at SIBOS – and PEI’s interest in recruiting those SWIFT-based companies happened during the time the MOU was in effect.

Article Comments

Alan Hicken

December 31, 2019 7:11 amThanks Kevin, I am concerned little has changed to bring the root corruption to an end. McLaughlin Liberals provided a cover up for Ghiz and company’s transgressions and greed. I had hope the new PC government would make all transparent that led to this in the beginning. Continuing to hide documents and / or electronic mail only leads to suspicions. So much for open and transparency and real democracy. Finally disgusting for a judge to not be provided all documents as the law requires is par the course for this banana republic. Happy New year .