YOU KNOW YOU BROKE THE MOU!

![]()

PREAMBLE

On November 22, 2017, the PC Caucus gave Steven Myers enough time in Question Period for him to ask FIFTEEN (15) questions about a shocking new revelation the PCs had uncovered after receiving new E-gaming FOIPP documents. Questions were directed to both the Premier and the Minister of Finance, Allen Roach.

In this Post, I’m presenting 4 video clips, each with one question and response. That should be more than sufficient to show how Myers managed to force a key admission from Minister Roach that the legally-binding exclusivity clause in the MOU with CMT/FMT was breached.

If you’d like to see the entire exchange – which I would normally encourage you to take the time to watch, and put a link to – you’re out of luck. Click this link and see for yourself that the video for the November 22nd session is gone – in fact there’s only two videos there. The Hansard written transcript is on the website, but for reasons I have neither investigated nor speculated about, that very important November 22, 2017 video (and many others) have been removed from the website. No matter. I had a copy.

I’m presenting this article in two “Parts” – the first being preparation and background documentary material, mostly from new FOIP documents never presented to Justice Campbell or CMT’s lawyer by Jonathan Coady, acting on behalf of his client, the PEI Government.

Part I is more work and less entertaining, but please persevere: you’ll gain the ability to tell what’s true and what’s fabricated in the video clips and be able to discern two important things: (a) that everything Hon. Steven Myers said about the MOU breach [which the King Government has now turned it’s back on] is true, and (b) that everything Minister Allen Roach said is either completely misleading, totally useless information, a blatantly obvious diversion, or “a little white lie” on steroids.

***************

PART I

PEI’s Auditor General, Jane McAdam, noted in her E-Gaming Report (on several occasions) that MOUs were not something the PEI Government normally signed with companies. She expressed considerable concern over the legal liabilities that might accrue to the taxpayer from signing such an agreement with legally-binding confidentiality and exclusivity clauses.

The Auditor General was aware that Innovation PEI had a mandate that made it “…responsible for growing the strategic sectors of…..financial services…”, introduced in the 2012 Spring Throne Speech, yet almost immediately after, Billy Dow and Cheryl Paynter signed an agreement that imposed a legal obligation on Innovation PEI to cease all financial services recruitment efforts that were already underway, and undertake no further recruitment activity for the financial services sector:

Section 5.11: Further, clarification on the terms and conditions in the agreement was not obtained. This was particularly important for Innovation PEI because the wording of the exclusivity section was very broad. Financial service was a key sector identified by Innovation PEI for economic development in the province. Innovation PEI senior officials advised that they were concerned about the exclusivity clause and how it would impact their work.

As it turned out, they needn’t have been concerned – the recruitment work carried on like usual and new recruitment missions targeting financial services companies were planned DURING THE MOU PERIOD, including one to Boston where former Premier Pat Binns participated. But that’s for another Post.

Given the secrecy and unusual way the MOU came into effect, it’s unclear what other government staff who were working on prospecting new financial services companies to PEI knew about the MOU.

No Board Knowledge or Involvement with MOU

The irregularity of the MOU was magnified by the fact that the MOU initiative did not come to Innovation PEI from the company (FMT), but rather Innovation PEI’s outside legal counsel, Billy Dow, who also happened to be an investor in the venture at the time.

Innovation PEI’s Board of Directors is the body invested with both the legal authority and duty to make such out-of-the-ordinary decisions like signing exclusivity agreements, especially when such agreements constitute legal requirements to effectively cease all existing activity and stop any further communications with other financial service companies during the term of the MOU.

The Auditor General told Public Accounts Committee members that it is reasonable to expect that the MOU would have been brought to the Board’s attention for them to decide whether it was something Innovation PEI should be signing – the AG didn’t see any documentary evidence the Board even knew about the MOU. I decided to see if I could get a more definitive answer to the question and submitted an Access Request with the following search criteria:

Innovation PEI Board Minutes. All communications between the CEO of Innovation Paynter at the time, Cheryl Paynter, and the Board of Directors pertaining to Board meetings (agendas; preparatory notes; etc.) as well as all communications between board members and the CEO that make mention of the MOU signed with FMT/Trinity Bay Technologies on July 6, 2012. Time period: June 1, 2012 to May 31, 2013″

The response to the request for non-Board minute documents (emails, etc.) came back “No records found”. The Board Minutes made no mention of the MOU, or not much else for that matter.

Why Would Staff be Informed when the CEO didn’t believe the MOU was “Binding”?

There is no evidence I can find that staff at Innovation PEI (especially Brad’s Recruitment Division) ever heard about the MOU; or if they did, that they had any idea it was any cause to stop recruiting financial service companies to PEI. They told the AG in 2015-16 during her audit that they were (back in 2012) “concerned it would impact” – not that it “had impacted”. I’m sure that’s something the AG would have been mentioned in her report if it had been mentioned or happened.

Cheryl Paynter, the CEO of Innovation PEI who signed the MOU, expressly told Brad Mix [in an August 29, 2012 email] that the MOU was not really binding: with no mention at all of the legally-binding exclusivity and confidentiality clauses in the agreement that CMT, the Defendants accept are “legally-binding”.

And Paynter was entirely mistaken about “financial services centre” not being defined. The parameters for what had to be kept confidential and exclusive were completely comprehensive and crystal clear – basically a “Shultz” clause – know nothing, say nothing!

“Again, sounds like some former dealings on the gaming file.” Remember that comment from Paynter, showing that Laslop’s proposal didn’t originate from within Innovation PEI, but came to the CEO from Sheridan and LeClair.

Read the Exclusivity Clause in the MOU that was entirely drafted by CMT’s lawyer, Gary Jessop. Billy Dow did not amend one word when he put it in front of Cheryl Paynter to sign. It’s not surprising the AG was concerned about legal liability – Jessop made it so PEI couldn’t even “discuss” the issue or share that it had any interest in the issue (never mind quibbling about the precise meaning of “financial services centre”).

Cheryl Paynter (and everyone else at the time) had it in mind that the MOU was in effect until end-of-day, September 6th. This email to MacEachern September 6, 2012 and began by drawing attention to the belief that the agreement was ending the same day:

Much later, when the lawsuit began and the lawyers counted the actual “days” for the 60-day agreement, it was realized that the “technically legal” end-date for the MOU was actually September 4th, as was several times noted in Judge Campbell’s ruling.

Cheryl’s cautious remark to Brad Mix about Chris LeClair’s client (Keith Laslop) holding off on sending his financial services payment centre ‘Business Plan” to Wes Sheridan came a little too late.

After meeting secretly with Sheridan on August 29 and getting the green light, LeClair and Laslop were chomping at the bit to get things formally launched. It had obviously been decided that it wouldn’t look good to have a date on Laslop’s business plan during the period the MOU was still in effect, so they were aware they would have to wait a few days.

LeClair wanted to know exactly who was to receive the plan, and the day before the MOU was to expire, he sent the following email to Wes for guidance:

Sheridan responded with succinct instructions:

“Let’s….” = Let Us! Not, “You can inform Mr. Laslop that….”…this was not an “unsolicited proposal” like Miniser Roach told the House – Sheridan was part of that insider club for the scheme – knew Laslop from the previous year where it was explore with Laslop with the entire “secret” E-gaming Committee (Gary Scales, Chris LeClair, Mike O’Brien, Kevin Kiley and Don McKenzie) but was apparently abandoned when the formal support was withdrawn in February, 2012.

“Let’s….” = Let Us! Not, “You can inform Mr. Laslop that….”…this was not an “unsolicited proposal” like Miniser Roach told the House – Sheridan was part of that insider club for the scheme – knew Laslop from the previous year where it was explore with Laslop with the entire “secret” E-gaming Committee (Gary Scales, Chris LeClair, Mike O’Brien, Kevin Kiley and Don McKenzie) but was apparently abandoned when the formal support was withdrawn in February, 2012.

THIS IS a KEY INSIGHT. Up until that point with the push for a “regulated” gaming platform it was recognized that a SWIFT-Accredited platform would be required. After February, 2012 – when the scheme apparently started in earnest to squeeze FMT out of the picture (not by everyone, but Sheridan, LeClair and the other members of the Secret egaming working group). That’s when Laslop and Wes Sheridan’s insider connections at the Credit Union came back into play.

With the effort to become a “regulated” gaming hub gone, the need for a SWIFT-accredited global financial services platform not was not only unnecessary, but became an impediment. The secret egaming group’s scheme was to cash in on “online gaming” with Newco’s Payment Transaction Platform and.

If Innovation PEI had signed an EXCLUSIVE Agreement with FMT granting “first mover advantage” as promised in the initial Recruitment Package – which seemed imminent – then FMT would have had become the exclusive transaction platform, preventing Laslop/LeClair/Sheridan/ and others from acquiring their online gaming “golden goose”.

Granted. At this juncture I’m conjecturing. But note the following from Laslop’s Business Plan sent to Sheridan drawing attention to how the PEI Governement would not have to be involved as a “regulator”:

Everything was going as planned, but unfortunately Laslop and/or LeClair’s had itchy fingers, couldn’t wait for the MOU to expire at end-of-day, and hit the SEND button at High Noon…we might be the east coast, but it was the “wild Wes” running the show on September 6th, 2012:

Everything was going as planned, but unfortunately Laslop and/or LeClair’s had itchy fingers, couldn’t wait for the MOU to expire at end-of-day, and hit the SEND button at High Noon…we might be the east coast, but it was the “wild Wes” running the show on September 6th, 2012:

The New Newco/Lapslo FOIPP Documents after Motion Hearing to Dismiss

New FOIPP documents were obtained after the Motion Hearing to dismiss last April, 2019. CMT’s legal counsel provided copies of those new and materially-relevant documents to PEI Government’s legal counsel, Jonathan Coady; however Coady would neither allow CMT’s lawyer to present copies to Judge Campbell nor do so himself.

For reasons that totally escape me, Jonathan Coady then served CMT’s lawyer with a “Supplementary Affidavit” containing those new Laslop documents AFTER Judge Campbell dismissed the case, so he never got to see them.

Judge Campbell did see the next Laslop’s Business Plan – but he put zero weight in it, referencing the fact that it was dated September 6th and the MOU had “technically” expired on September 4th, also noting that the MOU extension had not yet been “signed” on September 6th (although it was agreed to be signed “in principle” all along, and confirmed that it would be in an email from the Deputy Minister, Melissa MacEachern, on September 7, 2012 ).

Now that you know a bit about the discussions, meetings and prepared plans that took place between Chris LeClair (Laslop’s Agent) and Laslop and Wes Sheridan – a meeting that happened when the MOU was fully in effect – it’s easy to see that the planning and preparation was well underway so a quick jump could be made to the Laslop train immediately after the FMT MOU expired.

Consider the following paragraphs from that Newco business plan [Note: both bold and underline emphasis added…got carried away]:

We can safely dispense with any “technical” considerations concerning whether the MOU was still in effect at 12 noon when Laslop’s fired off their proposal to Wes Sheridan, especially given that it was initially intended to be September 6th – and that date is what was always understood and included in documents by everyone. That doesn’t really matter now that these new FOIPP documents reveal a substantial relationship between Laslop/LeClair/Sheridan/Roach as well as other MOU breaches with other companies that happened during the time the MOU was in effect.

This email from Cheryl Paynter to Brad Mix when the MOU was still in force discussing getting the recruitment package ready for Laslop but not sending it until SEPTEMBER 6th when the FMT MOU expired looks a lot like the proverbial “nail in the coffin” to me, but I’m not a lawyer:

No communications or dealings with any financial services company about anything related to establishing a financial transaction platform in PEI was allowed under the exclusivity and confidentiality clauses in the MOU. What more needs to be said?

As Steven Myers so eloquently and passionately puts it to the previous Liberal Government: you know you broke the MOU!

Well, so does the King Government! So can someone explain to me why no one else seems concerned that the PEI Government is now saying to the Appeal Court that no MOU breach ever happened and they don’t know a thing about Paul Maines or CMT/FMT? Meanwhile, not a peep from the Leader of either the official Opposition, Peter Bevan-Baker, or any Liberal opposition MLAs.

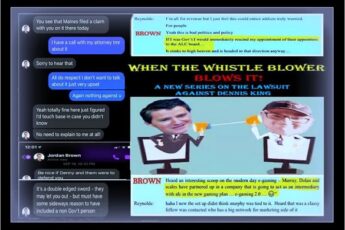

The PCs obtained new FOIPP documents in early 2017 showing that the PEI Government had lied in its Statement of Defense denying it had any dealings with any other financial services companies whatsoever during the MOU period. Those claims failed to mention anything whatsoever about the communications and meetings with Keith Laslop and Chris LeClair about setting up a financial payment processing centre in PEI, and when the PC Opposition learned that, they were incensed.

These new access documents revealing communications and meetings during the MOU were even tabled in the House by the PCs and made public documents! [Emails RE electronic payments processing company Newco].

What ever happened to the PC’s powerful and well-documented condemnation of then-Liberal Finance Minister, Allen Roach, drawing precise attention to the Minister Roach’s own involvement and knowledge of those communications with Chris LeClair and Keith Laslop when the MOU was in place. His attempts to shroud the revelation of Sheridan, LeClair and others positioning to slip into the same space that promised to CMT/FMT a year-and-a-half earlier, when FMT was offered “first-mover advantage”?

PART II

This first video clip was actually the last Question Myers delivered, but he offered a nice summary of sorts so I’ll lead with it. Also, I need to respond to what Roach says about the AG – she had no role to do what he suggests and he totally misrepresents what she actually did do:

Minister Roach mentions over and over that the Auditor General found nothing “illegal” in her Audit, adding that she even obtained legal counsel to confirm that nothing illegal happened. She did absolutely nothing of the kind! He says she brought in legal counsel on that issue but she didn’t! She brought in legal counsel on whether to take legal action to force McInnes Cooper to turn over documents and decided to put out the information she had with a section on all the “limitations” that prevented her from doing a more comprehensive audit review. The Auditor General obtained legal advice for herself and her ability to undertake her Audit – not matters relating to the e-gaming itself. She put those concerns in the Management Letter for Government – I assumed it was sent to the Premier or Attorney General’s office, but apparently not.

When the PC members of Public Accounts Committee later pressed the AG at Public Accounts on why she didn’t take action as a result of her discovery of various provincial laws having been broken, and possible criminal activities like “insider trading” by lawyer Billy Dow, her response was unequivocal and clear:

Leader of the Opposition: When you were given a mandate to conduct an audit and during that audit if you come across something that’s some type of unethical or illegal activity, is there any onus – onus is not the right word – would you ever notify another agency that maybe you should look into something? What I’m wondering here is this: If you’re doing your audit and during your audit you find something that possibly goes against the barrister society, would you ever let them or the RCMP or anybody else ever know that I’ve stumbled across something here?

Jane MacAdam: As I indicated with the issue with Bill Dow, we did communicate to government that there was an issue in the fact that he [Dow] had an investment in the parent company of Trinity Bay Technologies and he was involved in providing legal advice to Innovation PEI when they entered into that arrangement. In that case, we brought it to government’s attention. That’s an example where, yes, we saw something. If government wants to take it further, if they feel it’s necessary to go to the law society with that issue, then it’s up to government to do that. It was government that was receiving the services from the law firm.

I’m currently awaiting the outcome of a review with the Information Commissioner associated with my FOIPP Review to Premier King’s office asking for that infamous “Management Letter” the AG wrote to Government mapping out all those “ethical and legal” concerns.

Paul Ledwell – Premier King’s Deputy – wrote pages and pages saying that after an extensive search in the three different departments, the Premier’s Office, Department of Justice, and Attorney General’s Office, the Auditor General’s – the Management Letter could no where be located. I was invited by the Commissioner to respond to Ledwell’s response. This is what she forwarded to Mr. Ledwell several days later:

Let’s move on. Myer’s was in the zone!

Did you hear the off-mic comment at the very end? “That’s it right there!”

That’s Myer’s (I believe) responding to Roach’s confirmation that one of his staff members had indeed told him that a meeting had taken place during the time of the MOU [Wes Sheridan, Keith Laslop, etc.] to discuss Newco establishing a financial services payment centre in PEI. That would have clearly violated the legally-binding provisions of the MOU.

You can see that Myers really rattled Roach with this follow-up question. Roach confirms he had been informed that a meeting happened. Myers had knowledge of other communications and meetings, and all Roach could do was “take a pass” on answering the question pleading ignorance about the dates of the MOU, and promising to come back to the House with the information.

When Myers confronted Roach with additional information from the FOIPP emails that confirmed that it was not only a breach of the exclusivity clause, but clearly also the confidentiality clause with the sharing of this information with Chris LeClair and Keith Laslop allowing them to prepare a Business Plan, Roach was so discombobulated he could hardly keep his “answer-avoiding” talking points praising the AG straight.

For those interested, I have provided additional documentary evidence concerning the PEI Government’s breach of the MOU throughout many previous articles, but especially here: Episode #19: Covering up the Breach of the MOU – (Part 1) here: Episode #20: Covering up the “Breach of the MOU” (Part II) and here: Episode #21: Covering up the Breach of the MOU (Part III)

I can’t seem to figure out how to change that “Share if you Care” message. I’m not much of a website techie but I want to up the challenge to: